2026 Indoor Playground Investment Guide: The Revolution of Smart Growth and Capital Efficiency

Due to several consumer changes and the rising demand for families in cities, the Indoor Playground Industry has seen incredible growth in the last five years. This positive growth has shown some inefficiencies that greatly affect how the investments perform. Rising wages, increased seasonality, and the speed at which assets become outdated have increased OpEx volatility and reduced Gross Margins and EBITDA Margins. This has greatly impacted the investments.

2026 will see a fundamental shift in how investors expect this industry will manage and protect value. Investments will pivot to cash flow management via Radius Revenue Engine (RRF), which will prove to be a cost-stable and reliable income stream, rather than the current focus on the perpetual design and construction of additional facilities. The Indoor Playground Operators with the highest valuations are no longer real estate as a ‘building container’ but rather as ‘data assets’ with improved data utilization. They are promoting their facilities to achieve MRR via the capital efficiency of automated processes. This article outlines a forward-looking investment framework built on two pillars—Smart Growth and Capital Efficiency—and five core operational trends that institutional investors can use to screen opportunities and assess long-term value creation potential.

Pillar One: Smart Growth

How Does AI-Driven Dynamic Pricing Increase Gross Margin Without New CapEx?

Yield management employing artificial intelligence allows Indoor Playgrounds to dynamically set the price of every ticket and every add-on in real-time rather than establishing a price prior to the selling period. Artificial intelligence equips Indoor Playgrounds with the capability to price on demand by analyzing competitors’ prices for identical tickets, forecasting demand based on various factors such as the weather, timing of local school activities, local events, and historical queue data. Consequently, every ticket and add-on can be differentiated and sold at the optimal price for peak and off-peak periods.

Rooms with amenities that can be marketed as exclusive can be charged premium rates. This means that there is potential earned from the floor space available. More than that, the utilization of floor space is increased as there is a greater gross profit from the increased space that can be measured without additional construction costs.

How Does Edutainment Improve Pricing Power and Customer Lifetime Value?

Capturing the unique, structured, and experiential play learning is capitalized as high-margin income is earned from non-peak times. This, in turn, cascades to high CLV and frequent repeat visitations, thereby increasing pricing power. The educational entertainment with greater retention entails providing guided, ticketed, and educational activities, or entertainment, such as science VR, robotics workshops, and so on.

Service Upgrade: How Experiential Learning Enhances Value

There is loyalty from repeat patrons who pay premium rates for memorable educational experiences. The educational content premium is achieved in entertainment offerings, including scientific VR, robotics programming, and other STEAM activities. These workshops, which are more educational than entertaining, sustain the demand in low-demand periods and justify the increased pricing.

CLV Increase: The Effect of Prepaid Classes on Gaining Steady Revenue

Offering classes and camps that are prepaid creates an opportunity for repeat customers, which in turn improves the LTV: CAC Ratio, and self-funded classes reduce the acquisition pressure.

Additionally, within the limitations of a one-time guest, the educational offerings significantly focused on audience retention to turn them into repeat low-cost participants within prepaid classes and camps, significantly enhancing the lifetime value of a customer.

Data Insights: How Behavioral Data Optimizes Marketing

The individualized progress and engagement of children certainly can serve personal marketing and upselling, which aids in retention and customer lifetime value, as well as assists in more efficient marketing budget allocation. Less marketing spend is needed, engaging the proprietary data to enhance the marketing cost efficiency.

Pillar Two: Capital Efficiency

How Does Automation Stabilize OpEx and Protect EBITDA Margins?

Operational Expenditure (OpEx) in the Indoor Playground Industry considers the payroll as the single most significant and most unstable cost. This volatility can be attributed to wage inflation, the level of demand, and the attrition of workers. Under these conditions, automation is the best way to control these costs and to improve EBTIDA Margin, rather than being an improvement to the service.

Front-of-House Automation: How Self-Service Systems Reduce Cost per Visit

The automation of front-of-house functions lessens the labor intensity while increasing the operational throughput of the business. Guests can efficiently check in, sign waivers, purchase tickets, and rent lockers without the need for an employee through self-service kiosks and mobile applications. This change allows the systems to free desk staff, lower service level staff, minimize peak time line-ups, and improve demand without additional capital expenditures.

Back-of-House Streamlining: How SaaS Platforms Compress Managerial Overhead

For the streamlining of back-of-house activities, the Staff and Inventory Performance Monitoring and Staff Tracking Automation features of operational systems based on Software as a Service (SaaS) technology provide valuable assistance. Managers can be provided with real-time dashboards, which greatly reduces the time demanded of management oversight in the off-peak periods, and demand-oriented scheduling prevents staff over-allocation in periods of low traffic. As a result of these functionalities, the cost base becomes significantly more operationally efficient.

Margin Outcome: Redeploying Labor to Revenue-Generating Functions

With the bulk of the administrative and transactional functions automated, the employees are able to shift their focus to more strategic and higher-value activities at the venue, such as event sales, upselling, and membership conversions. It also decreases the number of service personnel needed to cover a particular number of transactions, thereby improving revenue efficiency. This effect also improves the operational margins.

Trend 3.2: Modular Design and CapEx Flexibility

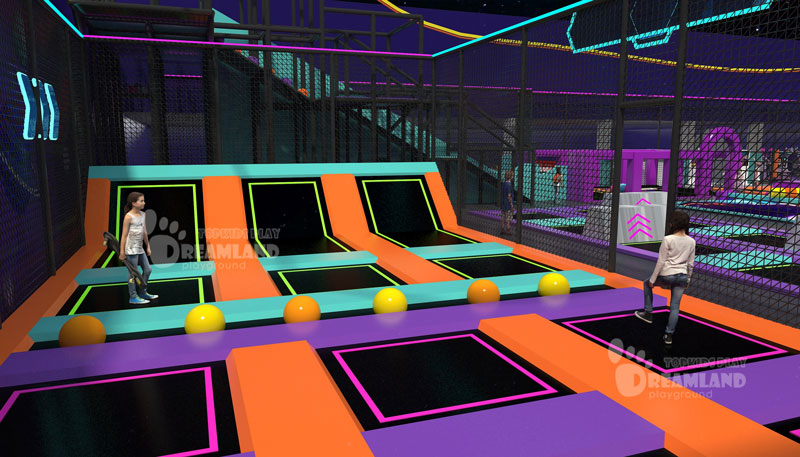

The changing designs and consumer preferences make the classic ones especially vulnerable. Operators can keep customer stimulation and retention even increase revenue without future cash outflows, by maintaining flexibility with the assets

The modular value of having adjustable features like play walls or domes thins out the costs and themes of the structures, since with them, no complete replacement is necessary. Also, structures will not depreciate badly as their novelty will be retained with repeat visits.

Reconfigurable Assets: How Modular Systems Preserve Value

The temporally adjustable structures that can be flexibly altered from anywhere in the range of 1 to 1.5 years keep them in high demand and allow for multiple visits. Absence of structures can be avoided by marking the momentum of the engaged structures and their assets.

The marketing of the structures enhances their functionality as the modular structures and designs let marketers deploy their capital and modular marketing, coupled with the structures increase their functionality.

Pop-Up Attractions: How Seasonal Flexibility Drives Repeat Revenue

How often these adaptable temporary structures can change, every one to one and a half years, will always keep them in demand and require repeat visits to the structures. Keeping the structures in the same location gets to market the structures and keeps the attention on the structures and the assets in use, without having to dispose of them.

Capital Objective: How Modular Strategy Improves ROI

The ability of marketing structures to incorporate capital function to increase the value of capital-restrained structures, to modular marketing design and structure to market vacancy.

Trend 3.3: Prioritization of the Subscription Economy and MRR

These types of businesses can more easily forecast cash flow and revenue with more accuracy, with the inclusion of Monthly Recurring Revenue (MRR). With revenue from contracts with customers varying from month to month, supply-demand cycles in contracts with revenue become a unit of a play proposition. MRR value becomes the employee value unit of the demand cycle proposition contracts. With revenue cycles, demand contracts become a transactional play proposition; MRR value provides a strong predictive cash flow. The predictive cash flow with the MRR value proposition provides a strong financial projection.

Tiered Membership Architecture: How Segmentation Maximizes Lifetime Value

Easy annual contracts can be switched to annual contracts to tiered subscriptions like Gold, Silver, and VIP contracts, which make it easier for employees to stratify customers by profitability and assigning customers profitability to individual customers' profitability. When customers can be segmented more efficiently, employees can better target each tier of customers to qualify for entitled operational benefits, without affecting operational spending to operational profitability. However, gains in operational profitability also bring more operational advantages.

Value Bundling Strategy: How Perceived Value Drives Retention Without Cost Inflation

The more bases an employee creates, the more that employee can increase base value perception without adding operational resource expenditure. By shifting existing resources operationally, more resources to stream without adding operational resource expenditure.

The result from the overall optimization creates a more operationally aligned organization within a smaller base, from which more than can be offset by the greater center of value perception created.

Impact of Capital Markets: Retrain Digital Assets to Increase Predictability and Investor Trust

The growth of a subscription base allows for greater seasonal demand to be smoothed out, increasing cash flow stabilization and making future earnings predictable. MRR, to those investors, becomes the most assessable metric for asset predictability, causing a greater valuation multiple and a lower risk profile within the Indoor Playground investment.

Investment in Intelligent systems above alternatives in other types of infrastructures in the context of indoor playgrounds in 2026 should consider that over the long term, the value from investments will gradually shift from hardware to software. The ability of investors to determine whether operators will be able to dynamically price to optimize RPF while balancing the high labor automation to keep OpEx within limits to protect the EBITDA Margins will be critical in revenue predictability in the form of generated Monthly Recurring Revenue.MRR. The adaptability of the asset also matters in that venues must be designed for easy and cheaper thematic shift alternatives to reduce the cost of obsolescence without triggering major capex. The expectation of institutional investors should improve the better these systems reduce the cost of obsolescence.

Frequently Asked Questions (FAQ)

Q1. How Are Valuation Models Changing for Indoor Playgrounds?

Valuation is currently on a trajectory focusing predominantly on cash flow visibility and quality as opposed to asset-heavy measurement. Matters like EBITDA Margin and MRR penetration, as well as RPF, and the LTV: CAC ratios, prove to be better long-term value predictors currently than factors like square footage or topline revenue.

Q2. How do we balance content refresh speed (technological obsolescence risk) with CapEx costs?

With the help of modular assets and software-driven experiences, it is easier to do incremental investments for small updates than it is to do a large CapEx cycle that is cash flow negative, so large updates can be avoided.

Q3. Is the subscription model (MRR) truly feasible in the low-frequency entertainment industry?

Absolutely. Subscription models launched alongside offerings that prioritize access, bundle benefits, and even include educational entertainment have been shown to increase audience visit frequency, as well as revenue predictability.

Q4. For chain operations, should we opt for third-party SaaS platforms or develop an in-house middle-office system?

In the case of most users, lower risk of execution and better scalability advantages, as well as faster deployments, come from third-party SaaS platforms. Internal systems are most often a case of large-scale and specific technology resources.