The Ultimate Guide to Indoor Playground Insurance

If you're starting or getting ready to start an indoor playground, Family Entertainment Centers (FECs), you're creating a space full of fun, adventure, and great childhood memories. Having fun also means being responsible and facing some risks. Accidents happen, even when you've done everything correctly. Maintaining the safety and security of your indoor adventure play center is included in this guide.Whether you run a small theater, trampoline park, playground, climbing area, or party venue, we will help you understand the types of insurance you need, how they work, and what to look for in a policy.

Why Do You Need Insurance for Your Indoor Playground?

You’re working with children, with people around and fast-moving play equipment, so there's always some risk involved. Insurance serves as your financial safety net, knowing that things can sometimes go wrong.

It helps pay for legal fees, medical bills, repairs, and lost income, so one bad event won't destroy everything you've built. Even if you are very careful, there is always a chance of:

- A child is leaving a place where they are crawling on the ground.

- A person slips in the coffee area.

- Supplies are being damaged or destroyed during the pandemic.

- An employee is injured because he is working for your company.

Without proper security, you could be held responsible for damages, which could cost you a lot of money or even put you out of business.

Types of Indoor Playground Equipment Insurance

As an owner of a playground park, you manage safety, keep customers happy, handle rules, and take care of business activities. Protection helps you deal with unexpected things. Let's look at the main types of security you need to protect your business.

1. General Liability Insurance

Approximate liability insurance is very important coverage you will need. This strategy keeps you safe from liability if someone gets hurt on your property or if their belongings are damaged. For example, if a child falls and breaks their arm or someone trips over a loose mat, insurance can help pay for medical bills, allowable expenses, and some decisions or outcomes. It's the basic part of some home insurance plans and is often needed to rent a place or get certain permits.

2. Commercial Property Insurance

Commercial Playground Insurance helps keep everything in a building safe. If your playground is damaged due to fire, vandalism, theft, or natural disasters, this plan helps pay for fixing or replacing your buildings, trampoline park equipment, furniture, electronics, and decorations. Because the actual reason behind the high cost of indoor play equipment is that it requires property protection, so having this means you won't have to pay extra if something goes wrong.

3. Product Liability Insurance

If you handle toys, snacks, or products, having product protection is an extra safety measure you need. This rule applies if a product you sell or promote causes damage or injury. Imagine someone buys a toy from your store, and it breaks and hurts their child. This kind of insurance helps deal with claims related to broken or unsafe products. If you use a stick, having safety measures for workers is probably a necessary rule in your area. It pays for your workers' medical bills and any lost pay if they get hurt while working.

4. Workers’ Compensation Insurance

A member hurt their back while in a party area. The peasants' insurance makes sure they get help and support without worrying about the ruling class suing them for costs. Are you providing services like hosting a birthday party, organizing events, or teaching classes? If so, you need professional liability insurance, which protects you from mistakes and issues that might come up. It keeps you safe if a customer says your services caused them to lose money or get hurt. This might be due to arranging errors, actions taken without guidance, or confusion about what was promised.

5. Business Interruption Insurance

Although it is sometimes disregarded, trade interruption security is crucial. This strategy will help you make up the money you lost if your firm has to close for a while due to a fire, flood, or running out of supplies. It helps you start paying rent, staff wages, and services again, even while you're managing your business, keeping your finances stable as you recover.

Factors That Affect Your Insurance Premium

When you begin shopping for home insurance, you'll quickly see that prices can vary a lot. Insurers look at several important factors to understand how risky your business is and how much they should charge to cover that risk. Knowing these factors can help you make quicker choices that could save you money and create more opportunities.

1. Size and Layout of Your Facility

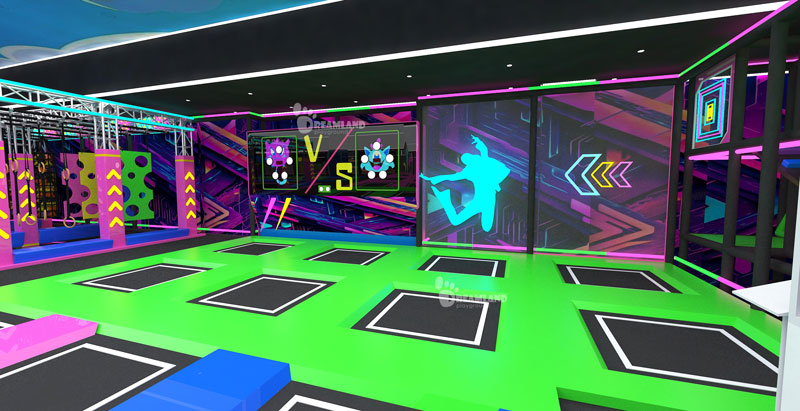

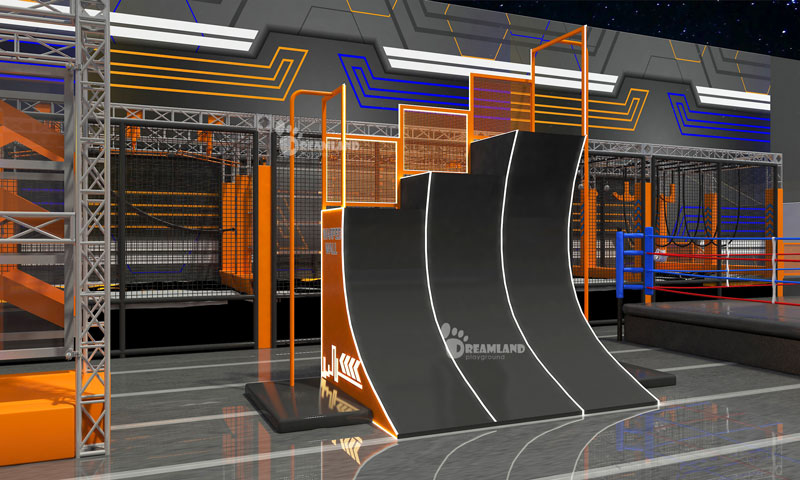

First, how strong your comfort level is and where it is located matter more. A better plan usually means more benefits and protection against accidents or damage, but it often comes with a higher cost. The bigger the movie, the more it costs to take care of it. If your design has very risky features like climbing walls, playground slides and climbing structures, acrobatic activities, interactive playground equipment, zip lines, ninja course equipment, or foam pits, sports arena attractions, you should expect your insurance costs to be higher because of those added risks.

2. Location of Your Business

Your job position influences your security level. If you're in an area that faces serious problems like floods, earthquakes, or hurricanes, typical safety expenses can go up. Similarly, if your playground is in an area with higher crime rates, the chances of theft and damage can cause your insurance costs to go up.

3. Annual Revenue and Guest Volume

In simple terms, a business in a safe and low-risk community can enjoy slightly lower prices. Insurance companies will also consider how much money you make each year. Higher pay often means more guests, which makes it more likely to receive claims. Creating more services is good, but it also means you need to improve your security as well. If your park has a lot of visitors or big events, that can affect your prices.

4. Type of Equipment and Attractions

You should also think about the nature of your products and how appealing they are. Safer options, like soft play equipment areas or baby zones, sometimes cost less than riskier things like rides or gymnastic equipment. The more important and urgent your setup is, the more you need to spend to protect it from damage.

5. Claims History

Don't forget that your history of claims is important too. If you have asked for different types of protection claims before, insurance companies might see your business as very risky and increase your rates. If you have a good history and strong security measures, you can still get discounts or better rates.

6. Number of Employees

The number of staff you have affects your premium, especially for workers' payment protection. Using more stick methods can lead to more work-related injuries, which insurance companies will evaluate. Regular reporting and security training for your employees can result in long-term cost savings..

7. Safety Practices and Risk Management

In the end, how you deal with safety and manage problems can really matter. Setting up cameras, keeping equipment in good shape, using clear signs for different ages, requiring waivers, and training on safety all show insurance companies that you care about preventing accidents. In many situations, these actions can result in lower payments or eligibility for certain coverage.

How to Choose the Right Insurance Provider

Having a professional insurance agent is very crucial for your indoor playground's safety. You don't want to discover a weakness in your protection after something happens. To prevent that, you need someone knowledgeable who really understands the specific risks of your production. Here's how you can make a good choice:

1. Look for Industry Experience

Not everyone in security knows about the home park or family entertainment business. Pick a business or stockbroker that has skills similar to yours, whether it's trampoline park insurance, adventure play,fun play areas, gym facilities for crawling, or other fun attractions. They will understand the specific risks and can adjust your policy accordingly.

2. Choose a Provider That Offers Customizable Coverage

You also need a cookie-cutter method. The right insurance provider will give you coverage options that fit your needs, the things you do, and the services you want (like birthday parties or snack bars). The practice bundle helps you avoid paying too much for things you don't need and protects you from risks.

3. Highlight Transparency and Clarity

Request that your supplier provide a detailed explanation of what is and is not covered. You should know your deductibles, coverage limits, and what isn't covered clearly. A good insurance agent will help you understand the details in the fine print and answer all your questions clearly, without avoiding any explanations.

4. Evaluate Customer Support and Responsiveness

When something goes wrong, time is important. You want someone who gets paid, answers claims quickly, gives easy help, and is open to new ideas. Look at reviews and comments to see how new clients feel about the way their claims were handled and the service they received. The last thing you need to do is find something to hold onto during a tough time.

Tips to Lower Your Risk (and Your Insurance Premium)

Running a playground park has its risks, but that doesn’t mean you aren’t strong. The more you work to prevent accidents and keep your facility safe, the more you can reduce claims, protect your customers, and lower your insurance costs. Here are some helpful tips to understand risk better:

1. Check supplies regularly

Make it your first habit to check and ensure all your supplies are working perfectly every day. Check for loose bolts, worn-out stuffing, sharp edges, or anything that might be dangerous. Make a record of these checks and fix any problems quickly. Insurance companies will see that you take risks seriously if you have a strong support system.

2. Fully Train Your Staff

Your staff is your first weapon. Teach them about security codes, how to help customers, what to do in a crisis, and basic first aid. Assess their ability to manage risks, follow rules, and remain composed under duress. Well-trained workers reduce the risk of accidents and can even prevent lawsuits.

3. Use Easy-to-Read Security Signs

Make sure your playground has clear signs around showing age limits, height limits, play rules, and emergency exits. They should all be easy to see. Simple signs like "No Running" or "Socks Required" can prevent many accidents and show insurance companies that you are responsible.

4. Enforce Age-Appropriate Play Zones

Create play areas suitable for different age groups. Organize your equipment by how old it is or what it's made of to keep younger kids safe from things that might be dangerous. Use colored areas or barriers to divide spaces and make sure to follow those borders. This reduces crashes and makes people feel safer.

5. Install Surveillance and Security Systems

Freedom cameras serve two purposes: they help you watch real-time behavior, and they give useful video if something happens. Cameras make people less likely to break the rules and can help prevent false claims. Also, insurance companies often see the wealthy as a benefit when it comes to reducing risks.

6. Require Liability Waivers

Liability Insurance for Playgrounds means that someone is allowed to not meet certain requirements or obligations that they are usually expected to fulfill. Get all parents or guardians to sign a form that says they won't hold us responsible before their kids can play. This won't take away your allowed blame, but it can reduce your chance of getting into a disagreement. Math waivers saved in your system are easy to follow and help show your good behavior.

Conclusion

You’ve put a lot of thought into creating the ideal play area at home, school, or mall—now it’s time to protect it. Protection isn't just something to think about; it's what keeps you safe, helps you stay secure, and guides your growth in business. With the right insurance, problems like accidents, damaged supplies, or worker injuries won’t ruin your playgrounds.

If you are planning or upgrading your indoor playground, make sure to think about safety and security carefully. Dreamland Playground knows how to make safe and fun play areas, while also making sure they have the right agreements in place. Let’s talk: we can help you with park design, product suggestions, and safe layouts. We're here to support you in creating a business that is safe from the start. Get in touch with us to get started or ask for a free meeting. Your peace of mind begins now.